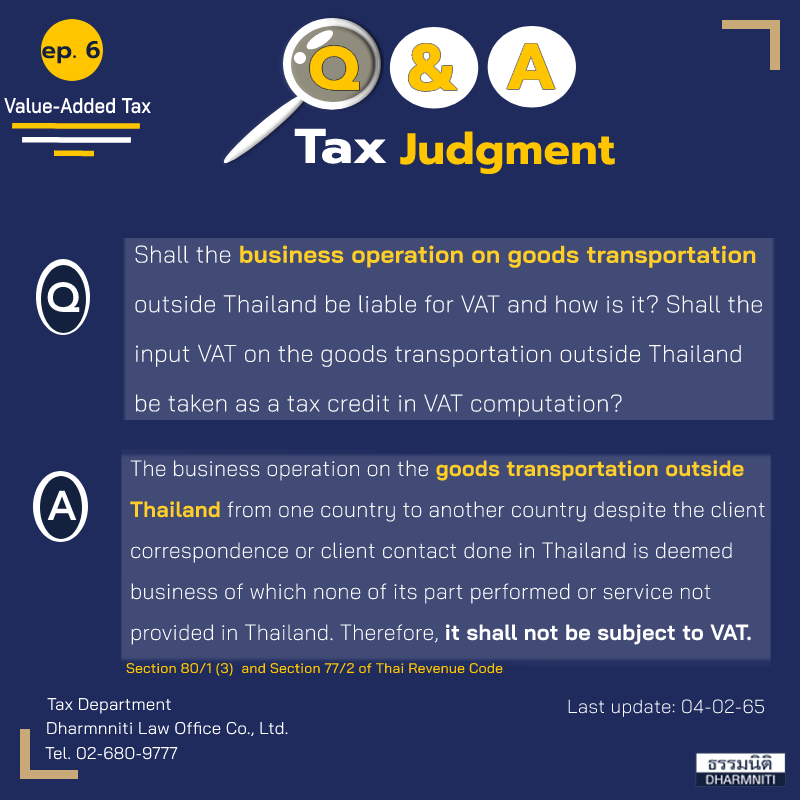

Q : Shall the business operation on goods transportation inside and outside Thailand be liable for VAT and how is it? Shall the input VAT on the goods transportation outside Thailand be taken as a tax credit in VAT computation?

A : The business operations on the goods transportation from inside to outside Thailand and the goods transportation from outside to inside Thailand are deemed business partially performed or service used in Thailand and shall be subject to VAT. Nevertheless, the business operation on the goods transportation outside Thailand from one country to another country despite the client correspondence or client contact done in Thailand is deemed business of which none of its part performed or service not provided in Thailand. Therefore, it shall not be subject to VAT in accordance with Section 80/1 (3) of Thai Revenue Code (“TRC”), in conjunction with Section 77/2 of the TRC. Thus, the input VAT on goods transportation outside Thailand shall be a non-deductible input VAT pursuant to Section 82/5 (3) of the TRC.

The Supreme Court Judgment No. 547/2555 (2012) The Plaintiff’s business operation on international transport services comprises the various businesses operations. Despite the fact that the TRC has no clarification of the meaning of the types of business for “international transport services” which allows the zero-percent tax rate for VAT computation pursuant to Section 80/1 (3) of the TRC, such provision in the mentioned Section shall be subject to Section 77/2 of the TRC whereby stating that “The following businesses performed in Thailand shall be subject to VAT under the provision in this Chapter; (1) sale of goods or provision of services by a business operator, (2) import of goods by an importer.

Provision of services in Thailand means services performed in Thailand whether or not the services are used in a foreign country or in Thailand.

Provision of services performed in a foreign country and used in Thailand shall be deemed services performed in Thailand.”

Hence, the international transport service to be subject to VAT means transport business partially performed or service used in Thailand. Each business is in need to be considered separately.

The business operations on the goods transportation from inside to outside Thailand and the goods transportation from outside to inside Thailand are deemed business partially performed or service used in Thailand and shall be subject to VAT.

Nonetheless, the business on goods transportation outside Thailand from one country to another country is completely a goods transportation outside Thailand. In spite of the fact that there is a client correspondence or client contact taken place in Thailand, the essential feature of the service directly provided by the Plaintiff is the service on goods transportation. It is deemed no goods transportation partially performed or service used in Thailand. Accordingly, it shall not be subject to VAT in accordance with Section 77/2 of the TRC and the Plaintiff is not entitled to take this amount of input VAT to credit in the VAT computation process due to non-deductible input VAT not directly associated with the Plaintiff’s business operation as a VAT registrant pursuant to Section 82/5 (3) of the TRC.

Except where otherwise indicated, content on this site is allowed to be used under

Except where otherwise indicated, content on this site is allowed to be used under