Tax Judgment EP6 VAT and Non-deductible Input VAT

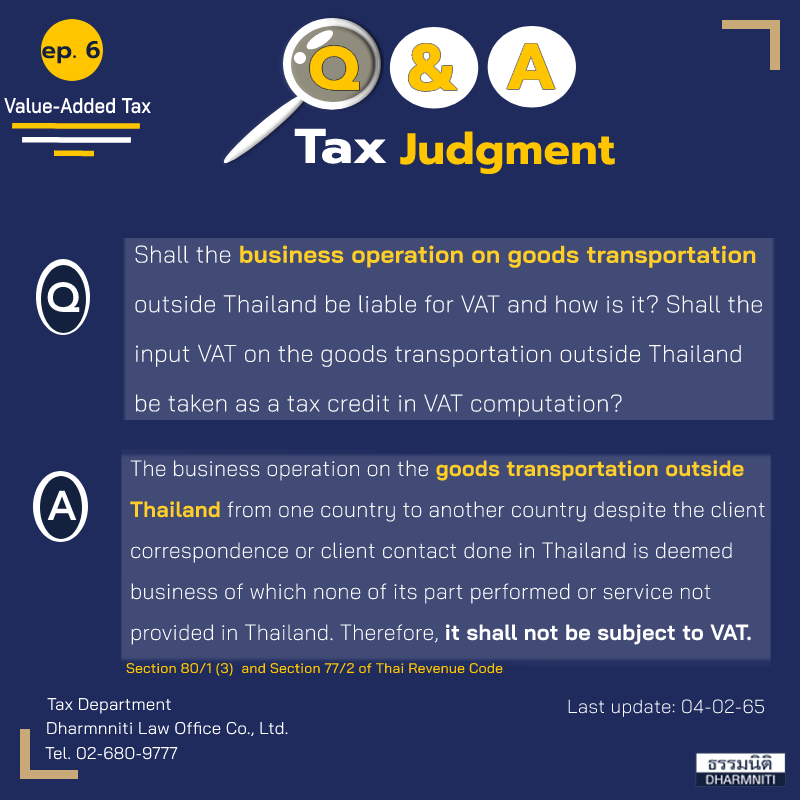

Q : Shall the business operation on goods transportation inside and outside Thailand be liable for VAT and how is it? Shall the input VAT on the goods transportation outside Thailand be taken as a tax credit in VAT computation? A : The business operations on the goods transportation from inside to outside Thailand and the goods transportation from outside to inside Thailand are deemed business partially performed or service used in Thailand and shall be subject to VAT. Nevertheless, the business operation on the goods transportation outside Thailand from one country to another country despite the client correspondence or client contact done in Thailand is deemed business of which none of its part performed or service not provided in Thailand. Therefore, it shall not be subject to VAT in accordance with Section 80/1 (3) of Thai Revenue Code (“TRC”), […]

Except where otherwise indicated, content on this site is allowed to be used under

Except where otherwise indicated, content on this site is allowed to be used under